-

On this episode

This episode is sponsored by NYDIG.Download this episode

On today’s episode, NLW breaks down a slew of stories that reflect different aspects of the crypto industry:- Billionaire John Paulson doesn’t like crypto

- FTX US acquires LedgerX

- Syndicate DAO raises $20 million

- Layer 1 battles with Ethereum and Solana

- Vintage Bitcoin-based “Rare Pepes” get repurposed and sold on OpenSea

- Treasury trying to add MORE rules for crypto reporting

See also: FTX.US to Buy LedgerX in Bid for US Crypto Derivatives

“The Breakdown” is written, produced by and features NLW, with editing by Rob Mitchell and additional production support by Eleanor Pahl. Adam B. Levine is our executive producer and our theme music is “Countdown” by Neon Beach. The music you heard today behind our sponsor is “Only in Time” by Abloom. Image credit: Malte Mueller/Getty Images, modified by CoinDesk.

What’s going on guys, it is Tuesday, August 31 and today’s news is wildly emblematic of the full breadth of the crypto industry today. So, I thought it’d be good to go through each of these stories and give them some context. And let’s start with one of the most classic tropes in this industry, an “old rich guy who doesn’t get it” story.

One of the interesting things about hedge funds and venture investors is that oftentimes, one really big contrarian bet that pays off can solidify an investor’s reputation for a very, very long time. John Paulson had one of those bets: betting against the housing market in advance of the great financial crisis.

That position ended up netting him in his investors something like $20 billion, which is very clearly a career-defining bet. However, it hasn’t been quite as good since then. At peak in 2011, Paulson managed $38 billion, that was down to $9 billion by 2019 when he shut down his hedge fund and started managing his own money, an estimated $3.5 billion instead.

This is not to scoff at a $3.5 billion fortune, but simply to point out that Paulson has proven himself to be pretty firmly in the camp of one really good call, which perhaps takes the sting out of his recent comments on Bloomberg Wealth with David Rubenstein about crypto.

The setup to that combo is one many Bitcoiners in particular will resonate with. Basically, he says that an expanded money supply is going to drive inflation. His bet, however, big-time, is gold. He’s backed it for years and this apparently is finally its moment.

Crypto, on the other hand, he says will “Eventually prove to be worthless. I wouldn’t recommend anyone invest in cryptocurrencies.” Santiago Santos said on Twitter: “It’s hard to know how much is luck versus skill in investing, unless you can win and lose on purpose. To this day, I doubt my ability.

Here’s Paulson, who got a tip from a Deutsche Bank trader to short housing, poor track record since. Won’t be as lucky this time with crypto.” Messari’s Ryan Selkis was a bit snarky here:

“John Paulson must be better than about 30 crypto investors and entrepreneurs have now leapfrogged him in net worth betting on gold versus digital gold. The financial internet and the user-owned economy at this point is record-shattering Boomer energy.

” What a savage and true phrase: record-shattering Boomer energy.

Next in this cavalcade of industry reflective stories, an institutional story. As we well know by now, the initial catalyst for this bull market was the surge of institutional interest in bitcoin in the wake of last year’s COVID-19 crisis.

This was, of course, embodied in Paul Tudor Jones’s “Great Monetary Inflation” thesis, which became a blueprint for so many hedge funds and institutional investors to get into bitcoin last year. We were initially buoyed and excited by the new institutional offerings and interactions that started sprouting up.

MicroStrategy and Square and Tesla putting bitcoin on the balance sheet, all of these major banks and investment houses launching bitcoin products, NYDIG, this show’s sponsor working with smaller banks around the country to offer bitcoin directly in people’s checking accounts.

Still, there are some who’ve been hoping for more new products. In particular, a Bitcoin ETF. The big question has been regulation and getting regulators comfortable with this emerging space on that front.

The interesting news today is that FTX U.S. has agreed to acquire LedgerX, one of the few exchanges with some key derivatives licenses for the United States. I won’t say much about this one because for disclosure, I work with FTX on marketing.

Instead, I’ll simply point to CEO Sam Bankman-Fried’s tweets, which I think tell the story pretty clearly.

He writes: “This is probably one of the most exciting announcements we’ve ever had. FTX U.S. plus LedgerX.

It’s been incredibly exciting getting to know the whole LedgerX team and watching them and our team work together on a common goal, one of the most exciting goals in the crypto ecosystem.

We’re excited to work with the CFTC on innovating in the U.S. crypto derivatives space in a regulated, understood manner. Common ground between regulators and industry is the foundation of safe, sustainable innovation.”

Back to our big list of stories, it’s not just institutionally recognized investment opportunities that are making news today. It’s also new crypto native forms, notably DAOs. Syndicate DAO announced that it has raised a $20 million series A backed by the likes of Andreessen Horowitz, Alexis Ohanian, Snoop Dogg and many others.

Another disclosure for you, I was an investor in Syndicate DAO’s community round where they raised $800,000 from about 100 people a few months ago. For those who aren’t familiar with DAOs, I loved this description from Cheyenne Ligon at CoinDesk, who wrote: “DAOs are basically shared bank accounts on the blockchain with tools meant to facilitate group decision making.

” That’s pretty much it. And I’m bullish, because it seems pretty obvious to me that in an internet native world, there’s going to be something between a Facebook group or a Discord server, and an LLC. Also, I think organizing around shared financial decisions is just super obvious, a key human social primitive.

Syndicate’s goal is to make the tools for building these sorts of resource coordination DAOs radically easier, and in doing so, opening them up to new communities. Their earliest DAO experiments have been focused on groups historically excluded from venture capital, including black and female founders.

What’s more, the team’s vision is about more than just capital in the crypto space. One of their founders said: “So, not only a protocol for investing in venture capital or other forms of private equity, but to also serve as a general purpose protocol for things like grant making, nonprofits or donations.

” Basically, as I said, it’s a bet that resource coordination and supporting others with money is a fundamental human social primitive that can use an update.Still not close to done though, are we? Nope, nope, nope, nope.

Let’s talk Layer 1 battles. First of all, in the Ethereum camp, Arbitrum from The Scaling Solution announced a $120 million raise and also launched its main net.

For the “explain it like I’m five,” here’s how The Block describes them: “Arbitrum is a Layer 2 scaling solution that promises to handle many more transactions than Ethereum at lower costs, it processes transactions on a side chain that uses optimistic roll-ups technology and then regularly settles them in batches to the main Ethereum blockchain.

” Arbitrum is one of two big Eth scaling projects, with Optimism being the other one, and the need for that is clearly on display right now.

NFT mania has caused ETH gas prices to absolutely skyrocket, and frankly, getting resources into scaling solutions isn’t the only impact. For weeks, ETH competitor Solana has been the talk of the crypto Twitter town, especially when it comes to that all important crypto technology, NGU, or “number go up” technology.

On that front, there was no one coming close to SOL right now. Solana is up 70% this week, 250% this month, and it’s getting in big on the NFT game and seems likely to attract even more attention in the weeks ahead. Now, as for this show, if you’d like me to dig in a little bit more on these Layer 1 battles, let me know.

One of the things that I think is most interesting is that one of Ethereum’s main critiques of Solana is that it isn’t decentralized enough. That’s the same critique that Bitcoin levies against Ethereum. The question is of trade offs and what sufficient decentralization really is.

Bitcoin has made a clear choice in weighing decentralization and the properties that it brings, including censorship resistance, higher than just about anything else. What are the differences and approaches of these other Layer 1s? If that is something that’s interesting to explore, let me know.

Next, though, what about an NFT story and this one tickles my history fancy just right. In the mid 2010s, a bunch of digital collectible cards called Rare Pepes, based around the Pepe the Frog meme, were minted. They were built on blockchain and traded on this tiny little platform, Counterparty.

In May of 2017, four years ago, investor Fred Wilson wrote about getting into Rare Pepes on his ABC blog. He tweeted: “About the coolest thing ever. What happens when you combine a crypto asset with a meme and a trading card?” and then wrote, “So why do I think this is interesting? Well, for one, it shows the utility of a blockchain in action.

You can buy, sell, hold and transfer digital assets, and they have value and are traded for other digital assets like BTC in an online global marketplace.

Anyone can make one of these cards and if they are determined to be rare, they become digital assets with value attached to them. It also shows how a game can be built on a blockchain with virtual goods and characters and more.

” Not bad for a guy writing more than four years ago.

Anyway, back to today. Apparently, a bunch of the owners of these things are using an old software protocol called Emblem Vault to reconfigure them for Ethereum, and then listing these wrapped Rare Pepes on OpenSea and they are making bank.

One that has a Pepe version of Dorian Nakamoto, who Newsweek called the inventor of Bitcoin back in 2016, sold for 111 ETH or around $352,000, another sold for 149.99 ETH, around $500,000. So clearly, there’s some value to both history and memes.

But with all of this happening, someone has to rain on the parade, right? It can’t just all be wild “number go up, things happen,” can it? Don’t worry, we still have our lovely Treasury Department.

And honestly, I swear at this point I get hives anytime I see Jerry Brito from Coin Center tweet. Last night, he wrote: “Treasury wants to add more crypto reporting requirements in the reconciliation bill,” with the hand covering face emoji.

Here’s the section he excerpts:

“The Biden administration is urging Democrats to include more rules for tax compliance on cryptocurrency transactions in the upcoming $3.5 trillion budget reconciliation package after a provision in the Senate passed infrastructure bill spurred a major industry lobbying offensive to limit the reach of new mandates.

The administration is hoping to add to the filibuster-proof package requirements that cryptocurrency businesses report information on foreign account holders, so that the U.S. can share information with global trading partners, according to an administration official who wasn’t authorized to speak for the record.”

The thing that I want to point out and conclude with, in addition to just the insanity of this being the way that rulemaking happens, which I’ve covered so much, I barely need to reiterate here, but just for the record, it’s f**king insane.

Anyway, I want to point out what seems to keep coming up over and over and over again about where some of the real fear is, from the end of the article on rollcall.com that Britto cites, here the last two paragraphs: “Treasury is preparing guidance aimed at quelling some industry and lawmakers’ concerns about the reach of the bipartisan infrastructure bill’s cryptocurrency rules.

The department plans to reiterate the rules won’t apply to certain parties that industry has warned don’t have the information on coin traders that the IRS would seek, such as minors.

Treasury has pushed against limiting rules from applying to decentralized and person-to-person exchanges, a matter the department believes should be left to the regulatory process to avoid court challenges and to give flexibility for crafting rules that aim to avoid business shifting to exchanges that lack reporting obligations, according to the administration official.”

The fascinating thing to me is that it’s just so clear where this battleground is going to be. And it’s going to be DEXs. It’s going to be peer-to-peer trading. These battles are going to be big, and if you think it’s quiet now, that’s just because these teams are absolutely gearing up for an insane fall.

So strap in, get ready. Enjoy your last beautiful gasp of summer. And we’ll be here to keep track of everything that’s coming down the pipe as it happens.

For now though, like I said, such a reflective day of what’s going on in this industry and I appreciate you hanging out as always. Until tomorrow guys, be safe and take care of each other. Peace!-

By

Admin

Admin - 0 comments

- 0 likes

- Like

- Share

-

Investors see an onramp to crypto and NFT adoption. Detractors see a flimsy business model and potential for abuse.

When Vincent Gallarte was laid off in July, the Manila IT analyst found an unusual financial lifeline: an online game that rewards players in cryptocurrency.

In his first two weeks of Pokémon-like questing and battling, Gallarte earned more than 37,000 pesos ($732), three times what he would have made at his “real job.

”Like a lot of newcomers to so-called play-to-earn games, the 25-year-old Gallarte hadn’t had any particular interest in the world of Bitcoin, Ether and other cryptocurrencies. Now he imagines a lucrative side-hustle.

“I started playing Axie the same day my employer terminated my contract,” he said. “I’m so grateful.”

Axie Infinity is among the biggest — and most polarizing — of these new games, which allow players to accumulate tradeable crypto coins.

To investors like billionaire Mark Cuban and Reddit co-founder Alexis Ohanian, who were part of a $7.5 million funding round for Vietnamese game-maker Sky Mavis in May, it’s a gateway to crypto for people around the world.

Others look at the buy-in cost, now more than $600, and the influx of newbies “working” for low-value tokens and see evidence the Axie Infinity model is unsustainable.

Axie Infinity’s daily active users swelled from 30,000 in April this year to more than 1 million in August, with most logging on from developing countries hit hard by Covid, including the Philippines, Brazil and Venezuela.

Originally built on the Ethereum blockchain, Axie recorded around $30 million worth of Ether transfers a day over the past month, according to Etherscan.

That’s not much in the $2.2 trillion universe of cryptocurrencies, but meaningful for players—and governments—in poorer countries.

On Monday, the Philippines’ Department of Finance and the Bureau of Internal Revenue reminded players that their Axie Infinity profits are subject to income tax, local reports said.

In Axie Infinity’s virtual world, players steer creatures called Axies — based on a Mexican walking fish called axolotl — to acquire coins.

Sky Mavis Chief Operating Officer and co-founder Aleksander Leonard Larsen says they take their responsibility seriously, monitoring the in-game currencies and tweaking the market as needed.

“Some people say we’re like the Fed,” he said in an interview. “We are ultimately the creators of this universe and are responsible for making sure that it lasts. We are always tracking the economy to make sure it stays at a healthy level.”

In Axie Infinity’s virtual world of Lunacia, players steer colorful, blob-like creatures called Axies to acquire two kinds of coins. Smooth Love Potions (SLP) are awarded for successful battles and can be cashed out or used in the game to breed new Axies.

Axie Infinity Shards (AXS) can be earned in seasonal tournaments or for selling Axies in the game’s marketplace. AXS can be cashed out too, but like other governance tokens, they’re designed to function like shares:

Sky Mavis says holders will eventually be able to vote on new game features or corporate spending proposals. Gallarte heard about the game from a cousin.

But players need three Axies to get started, at a minimum of around $200 apiece. That was far too much for the newly unemployed Gallarte.

çHe sought out a sponsor, someone who lends his Axies to new players in exchange for a percentage of their in-game takings, sometimes as much as 90%.

Anything a player earns with a borrowed Axie accrues to its owner, who is then supposed to wire the player his cut.Gallarte appealed through Facebook to the Real Deal Guild, a group of Filipinos who now sponsor hundreds of players.

They agreed to let him play their creatures for a small haircut: the guild would keep 30% of his earnings.

The boom has been a windfall for Sky Mavis, which takes a cut every time an Axie changes hands and collects a fee when players breed new, non-fungible token creatures.

Players have created more than 2 million of the digital monsters, and the Axie trade has generated more than $1 billion in transactions, the first NFT platform to do so, according to CryptoSlam, which tracks NFT marketplaces.

Axie Infinity generated just $21 million in revenue for Sky Mavis from its 2018 inception through July 1. Since then, it’s brought in $485 million. Players spend tokens to breed new Axies, which can be sold as NFTs. To prevent hyperinflation, Sky Mavis programmed Axies to go sterile after several rounds of breeding.

Players spend tokens to breed new Axies, which can be sold as NFTs. To prevent hyperinflation, Sky Mavis programmed Axies to go sterile after several rounds of breeding.

Virtual goods with real-world value have been a staple of gaming for years now. The difference between Axie and most other big in-game markets is that Axie encourages players to cash out and gives them the tools and transparency to do so.

Instead of a semi-sanctioned peer-to-peer exchange on an unauthorized third-party marketplace, Axie players can take their SLP and AXS directly to a major crypto exchange and sell for whatever’s on offer.

Recent demand from the Philippines was high enough for Binance to offer an SLP-peso trade, as does Manila-based BloomX.

Independent analysts say it’s no mystery why Axie has been a hit in emerging markets.

The price of AXS has soared in the past two months, a sharp contrast with the broader economy in the Philippines, where roughly one out of 11 people are still unemployed. (SLP tokens are less valuable and prices have been more volatile this summer.)

Access to cryptocurrency also appeals where local currencies are weak or, in Venezuela’s case, in crisis.Play to Earn

Axie Infinity's tokens have rallied during a boom in the game's popularitySource: CoinGeckoNote: Prices quoted are in U.S. dollar But the Axie frenzy has also bred criticism that the platform is propped up by new money drawn to a get-rich-quick premise. Vanessa Cao, founder of venture-capital firm BTX Capital, said the Axie model is “fundamentally unhealthy and unsustainable.

” “Players need to spend hundreds of dollars upfront just to play,” she said.

“It’s a wrongful concept. You can’t ask people to pay before even having any idea what the game is about.

”Cao offered Dream Card, from BTX portfolio company X World Games, as a counterpoint. It’s free to get started; its almost 560,000 users customize character cards and trade them.

X World Games doesn’t give a “misleading impression that Santa Claus is coming to town,” she said.

Would-be Axie players are active on Telegram and Discord, looking for sponsors help them get started. That’s how John Aaron Ramos, a 22-year-old university student in the Philippines, says he connected to a Venezuelan gamer in November, months before the game boomed. At the beginning, he earned up to 300 pesos ($6) a day.

Over the next four months, he bred new Axies and the price of Ether went up, increasing his earnings tenfold. He ended his relationship with his sponsor and built his own stable of contract players, lending Axies to 15 people including friends and relatives. He keeps 30% of their earnings.

In March, he bought two apartments south of Manila for his parents. He also bought insurance plans and is contemplating investing in stocks. “The value of Axie could fall, but I’m not worried,” Ramos said. “I must still have physical assets so that I am in a more secure position.

”Sky Mavis doesn’t regulate the relationships between sponsors and contract players, though in June, the company tweeted to condemn reports that sponsors were soliciting nude photos from female applicants.

“Axie Infinity is a digital nation and, like in any society, certain people might be criminals,” said Larsen. “How do we deal with those who might be abusing other scholars or players?

These are challenges for us internally.” The company has banned “several thousand” accounts for violating the game’s terms, he said, including for bot behavior or when there is “clear evidence of scams.

”The company seems more comfortable in the role of central bank. After the price of AXS rose nearly 650% from July to early August, Sky Mavis reduced the price to breed Axies. It cut by half how much users can earn each day on quests and increased the rewards available to better players.

Some of the risks for Axie Infinity players and investors are in line with the rest of the crypto world, where massive drawdowns are common. Cuban himself took a bath in June, when a coin he liked went from around $60 to 0 in a single day.

“The investment wasn’t so big I felt the need to dot every I and cross every T,” he told Bloomberg. “I took a flyer and lost.”

If AXS and SLP tank, as predicted by traders taking short positions against the coins, players may not be able to cut their losses. The game only allows them to cash out SLP every 14 days, a constraint that, like all lock-ups, chafes a lot more when asset values are falling.

As it is, there’s evidence new players may not fully understand how to protect their gains. Larsen says users seeking customer service help have emailed their crypto wallet passwords to the company.

For evangelists, the learning curve is the point. “It’s going to help digital-asset adoption 100%,” says Lennix Lai, Director of Financial Markets at OKEx, a crypto exchange headquartered in the Seychelles.

“Imagine a large group of people who have never had crypto before, who have never had a wallet and they’ve never transferred within the blockchain — here there are actually huge opportunities for crypto education,” Lai said.Larsen says the game has lasting appeal, whatever happens to the currencies.

“We see it as more of a social network than a game,” he said. “People come in because it's such a new opportunity, then they fall in love with the community and the game that we’ve been building over time.”

— With assistance by Felix Tam, and Amanda Wang

-

By

Admin

Admin - 2 comments

- 1 like

- Like

- Share

-

John Dexfolio Dexfolio Recently, I have seen multiple posts in fb about the boom of Axie Infinity and how it helped majority of users, implying that this is the next big thing. Iive learn DEX trade history as well from this DEX tracking App at https://www.dexfolio.org/

-

Francisco Gimeno - BC Analyst For many, an opportunity given to those who couldn't before to earn in the digital economy through a game that rewards in coins and even NFTs. It's also a kind of social media, like many video games in this era. For other, a flimsy business and frail of dangers. We see just the opportunity for many to understand better how digital economy works, crypto, tokens and tokenisation, even DeFi (whith products many also considere very risky too!), through NFT. Videogames are just the first iteration of what a Metaverse could be too. Amazing.

-

By

-

Recommended: Read This! Reasons Withdraw Bitcoin From Exchanges - Bitcoin Magazi... (bitcoinmagazine.com)#1 – If your coins are on an exchange, you need permission from the exchange to spend them. In your own custody, you can do whatever you want and pay whomever you want, whenever you want, at the fee you want.

You will understand this if you’ve ever wanted to move your bitcoin from an exchange and you were blocked because you needed to provide more identification documents or prove your source of income.

You may have been blocked because you reached a 24-hour limit of value you are permitted to withdraw. Your funds may have been unavailable due to unscheduled system maintenance. It is your bitcoin and yet you are in a powerless position.

Bitcoin doesn’t actually care who you are or how much you are transacting. You can move 100,000 bitcoin and you’ll be free to do that without any resistance any time of the day, even on Christmas Eve, if the bitcoin was in your possession.

#2 – Your coins might not really be there. What you see is a promise that if you ask for your bitcoin, they will give it to you.

But if the exchange gets hacked or if the CEO fakes his death and takes the private keys or if the government steps in, all coins could go bye-bye.

Newcomers log into their exchange and see “Balance = 1.0 bitcoin” and they think that is their bitcoin. It is not. That is a number on a screen.

The bitcoin is on the Bitcoin blockchain, the global distributed ledger. The entity that can move that bitcoin from one address to another is the entity that has the private key that generated that address. The user of an exchange does not have the private key, the exchange does! It is their bitcoin. The bitcoin belongs to whoever has the private key.

This is crucial to understand.The exchange just has a legal agreement that the bitcoin belongs to the user and they show the user their balance. But the user just has a login name, a password, and a promise. Not a private key.

A little sinister trick that blockchain.com employs is a 24-word password to log in to the website. This LOOKS like a bitcoin private key, but it is not. It is just a website-password. Blockchain.com has the private key. This is quite misleading, and confuses beginners as to the true nature of how Bitcoin works.

Many exchanges have been hacked and coins have been stolen from those exchanges:- Mt. Gox is the first and most famous.

- Quadriga CX, a Canadian exchange, went bust after the CEO — the only person in the company with access to the private keys (allegedly) — died (allegedly) while on a trip to India. The users lost all their bitcoin.

- Cryptopia, an exchange in New Zealand. They got hacked and users lost their funds.

- Binance. $40 million worth of bitcoin was stolen but Binance was wealthy enough to make their users whole. Embarrassingly, the CEO called for a rollback of the Bitcoin blockchain to recover lost funds but was laughed out of town.

- Most recently, the CEO of a Turkish exchange fled the country with $2 billion worth of bitcoin.

- There have been many others that I had not previously even heard about.

You might not trust yourself with self-custody. That is understandable. But it is your responsibility to educate yourself on self-custody or at least only partially-custodial collaborative custody. Most early Bitcoiners are likely sitting on a lot of bitcoin.

They must step up and look after their coins. People brand new to bitcoin can store their initial small stacks on exchanges and it won’t matter too much. But you, you are early.

You must take responsibility. All the information is available online and free.

#3 – If coins are left on the exchange, they can engage in fractional reserve lending, effectively inflating the supply of bitcoin. If there is a mass withdrawal by the public, exchanges can and have gone bust if they don’t have the coins that were promised.

Coins go bye-bye.Fractional reserve is the fraudulent practice for accepting a deposit, and then lending it out, but the depositor is given the illusion that their money is still available. Somehow this is both common and legal in the fiat banking world. If one bitcoin is deposited and then is loaned out, the depositor should not have access, similar to a term deposit.

This would be full reserve or one-to-one banking.If the depositor requests their funds, then what is returned to them is another depositor’s funds instead and, in theory, no one is hurt. But if many people want their funds at once, then the obligations cannot be fulfilled.This practice not only inflates the supply of money but is a systemic risk.

By withdrawing your coins, you eliminate the risk to you of a bitcoin bank run.Trace Mayer, a once loved Bitcoiner, started Proof-of-Keys Day, on the anniversary of the first Bitcoin block, January 3.

It started a movement where Bitcoin users celebrate by withdrawing all their coins from exchanges all at the same time, putting stress on the system, to keep the exchanges honest. Any exchange that was running on partial reserves could be exposed if enough people participated.

#4 – One day governments may outlaw withdrawals to private wallets, leaving your coins stuck and vastly less valuable. The real bitcoin economy would consist of the open peer-to-peer market outside of the exchanges while the coins trapped inside exchanges would be useless.

I am fully expecting governments to make it extremely difficult or outright ban coins from leaving exchanges into private wallets. We will fight back, no doubt. But the effort by governments will be futile. Most bitcoin is not on exchanges. My estimate is that about two million coins of the 18.7 million mined are on exchanges.

Bitcoin’s future is as peer-to-peer money, with most payments made on the Lightning Network. Coins on an exchange cannot serve this function. Exchange coins will always have a middleman that you will require permission from to make payments.

Coins stuck on the exchange due to laws cannot be used as bitcoin is intended and they will be less valuable. If I offer a service and charge in bitcoin, I will only accept real bitcoin outside of exchanges. I will not take payment from trapped bitcoin to my exchange wallet. I will not be alone.

Therefore, there will emerge a price difference between real bitcoin and IOU exchange-trapped bitcoin.

#5 – Powerful people who want Bitcoin to fail MAY be naked shorting it on futures markets. If we, The Resistance, buy bitcoin and extract it from the trading pool, we will eventually enforce a decoupling of the price of paper bitcoin vs physical bitcoin.

We are fighting the people who print fiat. It’s easy for them to naked short bitcoin and suppress the price because they can print money and therefore have no real risk.

*Click here to read more about how naked shorting can affect the price of assets.

Here’s why they’ll fail: there is an army of Bitcoiners, true believers, who are regularly buying bitcoin and withdrawing coins from exchanges. Most of the coins are off exchanges already. If the naked short attack succeeds in driving down the price, Bitcoiners will eagerly scoop up the cheap sats and remove even more bitcoin from the exchanges.

Miners can somewhat replenish the supply of coins on exchanges. Currently, miners could theoretically dump 900 bitcoin per day onto exchanges. When HODLers remove 900 bitcoin a day, the price is relatively steady.

Wild fluctuations in price can happen despite this, of course, as traders buy and sell coins between each other.

But as more and more coins are removed and as mining supply diminishes (halves every 4 years), there will come a point when not enough bitcoin is available.

This will cause a decoupling of the paper price of bitcoin on the futures market and real bitcoin that is demanded by HODLers or merchants.Be a part of the army to bring this day forward and make bitcoin successful sooner.

Regularly stack bitcoin — Dollar Cost Average (DCA) — and remove the coins from the exchange.#6 Unless you take coins into your own custody, you will never fully appreciate how Bitcoin works.

If you don’t appreciate it, you won’t buy enough of it. And this you will regret.You will need to learn more about self-custody and run a node.

This will also blow your mind and get you closer to the truth of how amazing this technology is. You might even start using the Lightning Network and be totally obsessed. In a good way.

This is a guest post by Arman the Parman. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

Crypto exchanges such as OKEx, Binance, Huobi, Kraken and Bitmex outline the key challenges they face in pushing to establish global operations.

Cryptocurrency exchanges have an important role in driving adoption around the world, but even the biggest operations face significant challenges when trying to expand their services.

The advent of Bitcoin (BTC) and the subsequent development and launch of numerous other cryptocurrencies have changed the way people look at transacting across the world. Dependency on traditional banking systems is no longer the only option available to people.

Blockchain networks and cryptocurrencies are able to bypass conventional financial systems and allow people to transact directly, without having to go through a centralized institution. In an ideal, cryptographically secure world, users would transact peer-to-peer, but there are some barriers to entry for the uninitiated.

Therefore, most of those new to crypto use exchanges as their entry points into the ecosystem as they convert their fiat currency into their cryptocurrency of choice. In 2020, users are spoiled by choices with the sheer number of cryptocurrency exchanges operating internationally.

Nevertheless, a handful of these exchanges are attempting to surge ahead of the pack and establish themselves as truly global enterprises. But what are the key challenges they face, and how have they gone about building their respective empires?A juggling act

It’s clear that building a successful cryptocurrency exchange requires an enormous amount of time and resources as well as the ability to jump through a number of hurdles at any given time.

This is compounded when working across borders and continents, given that many countries have their own regulations and laws around the use of cryptocurrencies and the transfer and flow of fiat currencies.

Jay Hao, the CEO of OKEx, told Cointelegraph that there are a number of considerations that make for a complex and challenging business environment, which means that “most CEOs in this business don’t get much sleep.

” He added:“Growing a global cryptocurrency exchange is probably one of the most difficult businesses to be in. There are many challenges from attracting and retaining the right talent to consolidating and expanding your user base, ensuring liquidity, depth of market, and an attractive product offering. You also have to make sure that the exchange is robust and secure, can handle high unexpected amounts of volume with next-to-no downtime, all the while meeting requirements from regulators. The list of challenges is actually endless.”

In a recent interview with Cointelegraph, Changpeng Zhao, the CEO of Binance who is otherwise known as “CZ,” stressed the importance of having a "global mindset" while maintaining a sustainable business model. In order to do this, CZ believes that exchanges need to understand the specific needs of users in different regions. “We have different approaches for various markets,” he further told Cointelegraph, adding:“To run a global business, we have to make sure we are always offering a solid infrastructure for the users and enhance their experience, which is especially important for the 24/7 crypto space. Then, we have team members from different communities to provide customized products and services to a local market, and ensure our marketing strategy is aligned with local culture, custom and language.”

Huobi’s head of global business and markets, Ciara Sun, shared a similar idea, highlighting two major considerations that the exchange has focused on since its founding: localization and regulatory compliance. Sun told Cointelegraph that having a sound grasp of the wants and needs of users is a driving factor in launching exchange support in new regions:“Localization doesn’t just mean offering the exchange in a new language. Users in different markets and regions each have different preferences, habits, and requirements, so we need to adapt to each audience and provide local users with highly tailored experiences.”

As Sun explains, understanding why users in specific countries or regions are looking to use cryptocurrencies also provides some insights into what sort of offerings will work in different places:

“We spend a lot of time learning the intricacies of a new market before we enter it.”Cointelegraph also spoke to BitMEX to gauge its views on the most challenging aspects of running a cross-continent operation. A spokesperson for the company highlighted customer support as a considerable undertaking and one that requires the highest amount of its resources:“As a 24/7 cryptocurrency derivatives trading platform serving users from around the world, our ability to provide seamless support, regardless of time zone, is an important part of our service. Our Customer Support team is now one of the largest teams within our organisation and offers support in multiple languages.”

A spokesperson for the exchange Kraken told Cointelegraph that regulatory considerations in different jurisdictions are some of the toughest challenges in terms of trying to set up new bases of operation:“Clear regulatory guidance is important because it helps determine what products we can offer and who we can target with our businesses. If done properly, it can also ensure a level playing field for all competitors. Additionally, education continues to be a focus of ours as well, as there are both awareness and knowledge gaps when it comes to crypto and its benefits.”

Navigating the global waters

So, becoming a global cryptocurrency exchange is not a clear-cut endeavor either, as there is no single regulatory body that exists for the industry. Given that cryptocurrencies have been in existence for just over a decade, regulation is very much down to individual countries and their laws.

Given that most financial institutions around the world face strict control measures from regulatory bodies, cryptocurrency exchanges have had to adopt similar practices.

Many of these operations have to abide by Know Your Customer and Anti-Money Laundering guidelines in order to operate.

As OKEx’s Hao explained, the company takes direction from the guidelines of the Financial Action Task Force, or FATF, when looking to branch out to new regions.

Nevertheless, Hao believes that a global body overseeing cryptocurrency regulation is an unlikely scenario, forcing the exchange to have a large legal team on board in order to ensure compliance in each jurisdiction where the exchange operates:“I think that it will be very hard to establish a global regulatory authority for this space as all jurisdictions have their own laws and requirements. They are also constantly changing as the industry evolves.”

Huobi’s Sun hammered home the importance placed on regulatory compliance by its exchange as a fundamental part of its business model. “It's crucial that a crypto exchange meets all local regulatory requirements with the proper licenses to operate,” Sun said, adding: “This requires an enormous amount of time and effort and most ‘global’ exchanges don’t actually bother with this but we believe it’s critical.

”A major takeaway from most of the exchanges is the challenging task of navigating a global landscape that has vastly different regulatory and legal parameters. Sun admitted that it is a difficult undertaking, but said that the first port of call is a country or region’s securities and exchange commissions and its financial regulators, adding:

“As of yet, there isn’t a global consensus for classifying and regulating digital assets, so each market is unique with its own complexities.”Binance’s CZ told Cointelegraph that the lack of a global body that governs all markets is down to the fact that the crypto industry is still in its infancy, meaning exchanges have to work closely with regulators in every single country:“To take the US for example, it has well-established legal and compliance systems, where a crypto exchange has to apply for various licenses from different states in order to serve citizens of those states. [...] For Binance, we always work closely with local governments and regulatory agencies and operate compliantly in all the jurisdictions we serve.”

Kraken’s spokesperson highlighted how operating in different continents requires specific compliance with various regulatory bodies and watchdogs and the rules that they set out.

These considerations go deeper than just adhering to KYC, AML and FATF regulations; they also include following United States sanctions, meaning that Kraken is prohibited from operating in some countries. The spokesperson added:

“We are also increasingly cognizant of maintaining compliance with global data protection regulations, such as the General Data Protection Regulation (GDPR) in Europe.”BitMEX’s spokesperson said that a key driver of success would come down to an exchange’s ability to adapt to regulatory parameters as it continues to develop. Additionally, the exchange sees that regulators all over the world are upping their interest in crypto, adding:“We welcome their efforts, as they will help to establish greater standards for the cryptocurrency market that will underpin the advancement of this rapidly growing asset class. We believe that the successful platforms of the future will be those that can quickly embrace and maintain these standards.”

Plugging into legacy systems

The proliferation of cryptocurrencies has been slow and steady over the past decade, but the industry has already made the traditional financial landscape aware of itself.

Nevertheless, “the new” still has to plug in and be compatible with “the old.” In order to create accessibility for new users, cryptocurrency exchanges have to create fiat gateways to their platforms, which requires building relationships and compatibility with the traditional financial system.

Kraken offered its take on the intersection of cryptocurrency and traditional banking, conceding that the relationship between the two is important to drive adoption of the former. Nevertheless, the apathy of some banking institutions and the difficulty of interfacing and working with such organizations is still a challenge, as it’s “time-consuming to come to terms with these partners,” the company stated, adding:“Despite the presence of many forward-looking banks, many others are extremely (and unnecessarily) risk-averse when it comes to crypto. This is unfortunate because they are depriving their clients of opportunities to engage with and benefit from this new and exciting opportunity.”

Further challenges are created by countries that try to apply existing laws to govern the use of cryptocurrencies. As Hao explained, “It’s a help and a hindrance” for the growth of cryptocurrency use, as some countries have developed crypto regulations upon realizing that the current framework cannot be adapted, while other jurisdictions are still lagging behind.

He added: “This can be to the detriment of cryptocurrency as it all depends on how crypto is defined in the first place.

”For Binance’s CZ, regulation is not necessarily in opposition to cryptocurrencies. CZ believes that supporting regulation can drive innovation and help shape the crypto and blockchain space, much like the evolution of foreign exchange trading:

“Given that the forex industry and the crypto industry, both driven by high technologies, share some similarities, forex regulation could serve as a good reference for regulators to formulate more supportive regulatory frameworks for the crypto industry.

”Huobi’s Sun believes that there is a changing attitude toward cryptocurrencies from regulators and the traditional financial system as they slowly gain an understanding of crypto and blockchain systems: “It’s only natural that forex regulation and banking systems have not yet fully caught up,” Sun said, adding that “current regulation continues to evolve as regulators adapt to the changing financial landscape.

”Sun told Cointelegraph that as a result, more and more traditional banking and financial institutions are onboarding the technology and opening up support to cryptocurrencies and exchanges:“We’re also seeing less resistance from legacy financial institutions and banks. [...] We’ve also partnered with banks to enable fiat gateways for local users in several markets, so while there’s still progress to be made, I believe the legacy banking system is moving quicker than anticipated.”

Ever-changing world

As the various representatives of these cryptocurrency exchanges have highlighted, the global cryptocurrency environment is a complex one. Building and launching a cryptocurrency exchange is a technical and challenging endeavor in and of itself.

Taking that exchange and launching support in different jurisdictions adds multiple layers of complexity that require an inordinate amount of resources and energy.

Given the effort required, exchanges that are slowly building a global footprint are surely at the forefront of the industry and are pushing the adoption and acceptance of cryptocurrencies around the world.-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

The last few months’ frenzy of institutional money flowing into Bitcoin (BTC) has seen crypto hitting the headlines — at the least as a novelty asset, at the most as a must-have.

There is undoubtedly a trend in the market toward greater awareness and acceptance of digital assets as a new investable asset class.

A June 2020 report by Fidelity Digital Assets found that 80% of institutions in the United States and Europe have at least an interest in investing in crypto, while more than a third have already invested in some form of digital asset, with Bitcoin being the most popular choice of investment.

A good starting point for institutional investors would be to differentiate between crypto (Bitcoin, in particular) and decentralized finance products. To date, most institutional interest has involved simply holding Bitcoin (or Bitcoin futures), with few players dipping into more exotic DeFi products.

There are a plethora of reasons for the recent Bitcoin rage.

Some would cite the relative maturity of the market and increased liquidity, which means sizable trades can now take place without resulting in excessive market movement.

Others would cite the unusual high volatility, high return and positive excess kurtosis (meaning a greater probability of extreme values compared with the stock market) of the asset class.

Bitcoin’s backstory and its limited supply that makes it akin to digital gold have also been highlighted, making it more and more attractive in a world of inflated asset prices and unruly monetary and fiscal policies.

However, the main reason for the recent institutional interest in crypto is much less philosophical, much more practical and has to do with regulations and legacy infrastructure.

Financial institutions are old behemoths, managing billions of dollars’ worth of other people’s money, and are therefore required by law to fulfill an overabundance of rules regarding the type of assets they are holding, where they are holding them and how they are holding them.

On the one hand, in the past two years, the blockchain and crypto industry has made leaps forward in terms of regulatory clarity, at least in most developed markets.

On the other hand, the development of the high-standard infrastructure that provides institutional actors with an operating model similar to that offered in the traditional world of securities now allows them to invest directly in digital assets by taking custody or indirectly through derivatives and funds. Each of these represents the real drivers in giving institutional investors enough confidence to finally dip their toes into crypto.Keeping institutional interest alive: What about other DeFi products?

With U.S. 10-year Treasurys yielding a little higher than 1%, the next big thing would be for institutions to look at investing in decentralized yield products.

It might seem like a no-brainer when rates are in the doldrums and DeFi protocols on U.S. dollar stablecoins are yielding between 2% and 12% per annum — not to mention more exotic protocols yielding north of 250% per annum.

However, DeFi is in its infancy, and liquidity is still too thin in comparison with more established asset classes for institutions to bother upgrading their knowledge, let alone their IT systems to deploy capital into it. Additionally, there are real, serious operational and regulatory risks when it comes to the transparency, rules and governance of these products.

There are many things that need to be developed — most of which are already underway — to ensure institutional interest in DeFi products, whether on the settlement layer, asset layer, application layer or aggregation layer.

Institutions’ primary concern is to ensure the legitimacy and compliance of their DeFi counterparts at both the protocol level and the sale execution level.

One solution is a protocol that recognizes the status of a wallet owner or of another protocol and advises the counterparty as to whether or not it fits its requirements in terms of compliance, governance, accountability and also code auditing, as the potential for malicious actors to exploit the system has been proved over and over.

This solution will need to go hand in hand with an insurance process to transfer the risk of an error, for example, in validation to a third party.

We are starting to see the emergence of a few insurance protocols and mutualized insurance products, and adoption and liquidity in DeFi need to be large enough to caution the investments in time, money and expertise to fully develop viable institutional insurance products.

Another venue to be enhanced is the quality and integrity of data through trustful oracles and the need to increase the confidence in oracles to achieve compliant levels of reporting.

This goes hand in hand with the need for sophisticated analytics to monitor investments and on-chain activity. And it goes without saying that more clarity on accounting and taxes is needed from certain regulators who haven’t emitted an opinion yet.

Another obvious issue concerns network fees and throughput, with requests taking from a few seconds to double-digit minutes depending on network congestion, and fees twirling between a few cents and 20 bucks.

This is, however, being resolved with plans for the development of Ethereum 2.0 in the next two years and also the emergence of blockchains more adapted to faster transactions and more stable fees.

A final, somewhat funny point would be the need for improvement in user experience/user interfaces in order to turn complex protocols and code into a more user-friendly, familiar interface.Regulation matters

People like to compare the blockchain revolution to the internet revolution. What they fail to remember is that the internet disrupted the flow of information and data, both of which were not regulated and had no existing infrastructure, and it is only in the last few years that such regulations were adopted.

The financial industry, however, is heavily regulated — even more so since 2008. In the United States, finance is three times more regulated than the healthcare industry.

Finance has a legacy operational system and infrastructure that makes it extremely hard to disrupt and tedious to transform.It’s likely that in the next 10 years, we will see a fork between instruments and protocols that are fully decentralized, fully open source and fully anonymous and instruments that will need to fit in the tight framework of the heavy regulation and archaic infrastructure of financial markets, resulting in a loss of some of the above characteristics along the way.

This will by no means slow down the fantastic rate of creativity and the relentless, fast-paced innovation in the sector, as a large number of new products in the DeFi space — products we haven’t even predicted — are anticipated.

And within a quarter of a century, once DeFi will have first adapted to and then absorbed capital markets, its full potential will be unleashed, leading to a frictionless, decentralized, self-governing system.The revolution is here, and it is here to stay.

New technologies have undeniably shifted the financial industry from a sociotechnical system — controlled through social relations — to a technosocial system — controlled through autonomous technical mechanisms.

There is a fine equilibrium to be reached between tech-based, fast-paced crypto and antiquated, regulated fiat systems. Building a bridge between the two will only benefit the system as a whole.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Amber Ghaddar is one of three founders of AllianceBlock, a globally compliant decentralized capital market.

With a vast amount of experience across the capital markets industry over the last decade, Amber began her career at investment banking giant Goldman Sachs, before moving to JPMorgan Chase where she held a number of different roles in structured solutions, macro systematic trading strategies and fixed income trading.

Amber obtained a B.Sc. in science and technology before graduating with three master’s degrees (neurosciences, microelectronics and nanotechnologies, and international risk management) and a Ph.D. She’s a graduate of McGill University and HEC Paris.-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

Cardano, now the third-biggest cryptocurrency after bitcoin and ethereum, has soared in recent weeks—outpacing even bitcoin's massive rally.The cardano price has surged a blistering 2,000% over the last 12 months, adding 300% in the last month alone.

Now, as the cardano network bobs around a total value of $40 billion, developers are gearing up for the launch of a major update on Monday—designed to make it into a multi-asset network similar to ethereum.

MORE FROM FORBES

Bitcoin Price Prediction: How Far Could The Bitcoin Bull Run Go?By Billy Bambrough

The cardano price has soared in recent weeks, with cardano breaking into the cryptocurrency top ... [+] LIGHTROCKET VIA GETTY IMAGES

"We can today confirm that the ‘Mary’ cardano protocol update is now fully confirmed for March 1," the Cardano core development team, Input Output HK (IOKH), said via Twitter this week.

"Another key milestone in the Goguen rollout, the update introduces native tokens and multi-asset support, bringing exciting new use cases for cardano.

"The update will allow cardano to support traditional-currency-pegged stablecoins and let users create non-fungible tokens (NFTs)—a way to prove ownership and authentication of everything from social media posts to digital art using public blockchains—which have exploded in popularity in recent weeks.

Cardano's upgrade comes as the ethereum price has rocketed over the last year, smashing through its early 2018 highs.

As well as the growing NFT market, ethereum has benefitted from the rise of decentralized finance (DeFi)—using cryptocurrency technology to recreate traditional financial instruments such as interest, known as "yield," and insurance.

Many of the biggest DeFi projects are built on top of ethereum's blockchain, pushing the ethereum price higher as users flood the network.Cardano and other potential rivals to ethereum, including the sixth-largest cryptocurrency by value, polkadot, are currently jostling for DeFi, NFT and stablecoin market share as ethereum struggles with slow transaction times and sky-high fees.

MORE FROM FORBESBill Gates Issues Serious Bitcoin Warning As Tesla Billionaire Elon Musk Stokes Crypto Price 'Mania'By Billy Bambrough

The cardano price has soared in recent weeks, taking cardano to a total value of over $40 billion ... [+] COINBASE

Cardano's price surge has catapulted it to prominence in the cryptocurrency community over recent weeks.

"Cardano is a rising star in the booming crypto sector," Nigel Green, the chief executive of financial advisory group deVere, said earlier this month alongside an announcement the deVere cryptocurrency exchange had added cardano to its supported digital assets.

"It has had a highly impressive run in recent weeks and there’s no reason why this will not continue. Cardano could, quite realistically, become an increasingly dominant rival to bitcoin, ethereum and tether."-

Francisco Gimeno - BC Analyst Cardano's upgrade is sold as a start point to make it a strong competitor for BTC, and mostly, Ethereum. With DeFi needing more speed and better gas prices, and the arrival of NFTs, Cardano could be an interesting alternative. We will see how this weeks develops.

-

-

- Meltem Demirors of CoinShares told CNBC on Monday that the “best time to invest in bitcoin was yesterday.”

- Her comments came as bitcoin’s market value recently topped the $1 trillion mark, according to Coindesk.

- Meanwhile, NYU’s Aswath Damodaran argues that bitcoin is “an incredible show to watch” but not an investment.

The reflection of bitcoins in a computer hard drive.Thomas Trutschel | Photothek via Getty Images

As bitcoin continues on its upward trek in 2021, one analyst says the regulatory concerns surrounding the cryptocurrency won’t likely derail its momentum.“The regulatory issues have been around for a long time, we’ve been dispelling them for a long time. At this point, our belief is: Bitcoin is not a question of if, but when,” Meltem Demirors, chief strategy officer at digital asset investment firm CoinShares, said Monday.

“We certainly believe, you know, the best time to invest in bitcoin was yesterday — the second best time to allocate is today,” she told CNBC’s

Her comments came after bitcoin recently toppled another milestone, pushing past $1 trillion in market value last week, according to Coindesk.Bitcoin has been on a tear since the start of 2021, and has risen more than 90% so far this year, according to data from Coin Metrics. Those strong gains have been attributed in part to increased adoption of bitcoin by major investors and companies, including Elon Musk’s Tesla and the Bank of New York Mellon.If it’s a currency, it’s a ... horrifically bad currency ... bitcoin seems to be primarily a speculative game.Aswath DamodaranPROFESSOR, STERN SCHOOL OF BUSINESS AT NEW YORK UNIVERSITY

“It’s becoming increasingly difficult for the bitcoin naysayers to continue with their decade-old narrative that bitcoin will never be utilized by traditional … financial institutions,” Dave Chapman, executive director at BC Group, told CNBC’s “Capital Connection” on Monday. “Frankly, I’m not sure how much more evidence one needs to conclude that bitcoin isn’t going away.”Bitcoin last sat at $55,867.95 per coin as of 3:45 a.m. ET Monday.

Allocate 4% to bitcoin in a traditional 60-40 portfolio, says strategistStill, Demirors warned that investors should not be allocating “significant portions of their balance sheet” to bitcoin.“Our research has found that in a traditional 60-40 portfolio, a 4% allocation to bitcoin balances the reward as well as the risk of drawdowns,” she said. The 60% stock and 40% bond portfolio is traditionally a popular allocation strategy designed to generate steady income while guarding against volatility.Bitcoin a ‘failed currency’?

Aswath Damodaran from New York University was far more skeptical about investing in bitcoin.“This is an ... incredible show to watch. But it’s definitely not an investment,” Damodaran, a professor of finance at NYU’s Stern School of Business, told CNBC’s “Street Signs Asia” on Friday.

Bitcoin is mainly a ‘speculative game,’ NYU professor says“If it’s a currency, it’s a ... horrifically bad currency,” he said, adding that bitcoin “seems to be primarily a speculative game” that has “behaved like a very risky stock.

”“It’s not an asset class. It’s a failed currency, at least into this moment,” Damodaran said.

“Let’s see whether they can fix it because ... I don’t think that they have an incentive to do so.”— CNBC’s Jesse Pound, Lizzy Gurdus and Sumathi Bala contributed to this report.-

Francisco Gimeno - BC Analyst Is investing in BTC a safe option? for many, yes. For others, not. It's a personal decision after looking at all angles, not moved by FOMO or FUD. The idea of crypto and particularly BTC is basic to the economy of the 4th IR. But using it as a speculative asset only may bring problems to those who don't really understand the game.

-

Sean Williams

(TMFUltraLong)

Author Bio

This article represents the opinion of the writer, who may disagree with the “official” recommendation position of a Motley Fool premium advisory service. We’re motley!

Questioning an investing thesis -- even one of our own -- helps us all think critically about investing and make decisions that help us become smarter, happier, and richer.

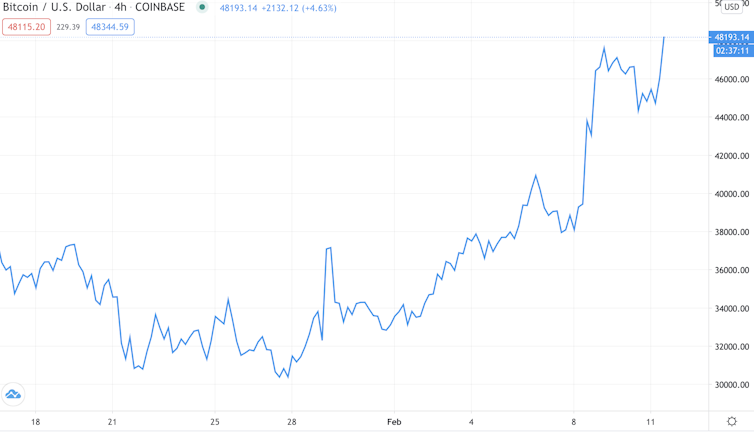

Earlier this week, Bitcoin (CRYPTO:BTC), the largest cryptocurrency in the world by market cap, hit a milestone. It handily topped the psychological $50,000 level. As I write this on Feb. 17, it's closing in on a market value of $1 trillion (about $25 billion away).

Bitcoin has gotten an extra bump in recent weeks from a handful of brand-name companies adding it to their balance sheets or accepting it as a form of payment.

Tesla (NASDAQ:TSLA) purchased $1.5 billion worth of Bitcoin to add to its balance sheet, with enterprise software company MicroStrategy buying in excess of $1.1 billion worth of tokens in December.

Even The Motley Fool has decided to purchase $5 million worth of Bitcoin to add to its balance sheet.

But at The Motley Fool, we strongly believe in understanding both sides to every investment. Personally, I don't think highly of Bitcoin. I have 10 reasons why I'll never buy it for my portfolio.

IMAGE SOURCE: GETTY IMAGES.

1. Its scarcity is a myth

Bitcoin optimists often cite its 21 million token limit. With 18.6 million Bitcoin already in circulation, it'll take close to 120 more years before the remaining 2.4 million are mined and put into circulation. The argument is that Bitcoin's fixed token count will help fight against the ongoing devaluation of the U.S. dollar as the money supply expands.

The flaw in this thesis is that Bitcoin's scarcity is nothing more than an illusion. While unlikely, community consensus could decide, at some point in the future, to increase Bitcoin's token count. Without any physical scarcity to speak of, a promise is all that keeps its token count from rising.

2. Its real-world utility is minimal

Though companies like Tesla are adding fuel to the Bitcoin craze, the reality is that it's not exactly a preferred form of payment. An analysis from business funding company Fundera found that approximately 2,300 U.S. businesses accept Bitcoin.

There are more than 30 million businesses in the U.S., including sole-proprietorships, and about 7.7 million that employ at least one other person. After a decade, Bitcoin has hardly made a dent on the utility front.

Also, don't forget that a vast majority of tokens aren't actually in circulation. Investors are holding on to them, which further limits Bitcoin's ability to be a medium of exchange.

IMAGE SOURCE: GETTY IMAGES.

3. The barrier to entry is almost nonexistent

Want to start your own digital token? If you've got money and time on your hands, you can create your own digital currency with tethered blockchain. The barrier to entry in the crypto space is exceptionally low, meaning there could be dozens of superior alternatives to Bitcoin or its blockchain in development or available for use. Having virtually no barrier to entry suggests that Bitcoin's first-mover advantage isn't a selling point.

4. It's difficult to short-sell, which leads to inefficient markets

In recent weeks, retail investors (who also happen to be the core fans of Bitcoin) have been in an all-out war with short-sellers -- i.e., investors who profit when the price of a security falls. Some even view short-sellers as evil. But short-selling is a natural part of the investing cycle that helps lead to price discovery.

Bitcoin is really difficult to short-sell on most platforms, which means we're not getting anywhere near a true price discovery. This market inefficiency is one of the reasons Bitcoin is so exceptionally volatile.

IMAGE SOURCE: GETTY IMAGES.

5. It isn't even the best option among financial networks

Bitcoin's network has been touted as a game changer for financial payments. Rather than using traditional banking networks and waiting up to one week for payment to be validated and settled, Bitcoin can do so in an average of 10 minutes.

However, Bitcoin's usage is strictly limited to the payments side of the equation, and it's not even the best network at what it does in the financial space.

Stellar (CRYPTO:XLM) can settle validate and settle financial transactions in mere seconds with its Lumens coin.

Meanwhile, Ethereum (CRYPTO:ETH) provides nonfinancial blockchain applications with the addition of smart contracts -- commands that are executable once all predetermined conditions are met. Once again, Bitcoin may have first-mover advantage, but it's not the most innovative or functional kid on the block by a long shot.

6. Blockchain has been an enterprise bust thus far

Don't overlook that the Bitcoin story is really about advancing its underlying digital ledger, known as blockchain. With blockchain, transactions can be validated and stored forever in a transparent and immutable way.

While there are plenty of applications for blockchain on paper, we haven't seen these ideas translate into real-world functionality.

Businesses have been unwilling to replace their proven network infrastructure with untested blockchain technology, creating something of a Catch-22.

CoinDesk reported that tech stalwart IBM (NYSE:IBM) practically dismantled its blockchain division, according to four people familiar with the matter. In short, enterprise blockchain has been a gigantic flop thus far.

IMAGE SOURCE: GETTY IMAGES.

7. Storage and security issues are worrisome

This is a bit more personal, but I have no desire to deal with the complexities of storing and protecting Bitcoin from hackers. Bitcoin must be stored in a digital wallet kept on a hardware-based platform or on the web. Either way, it can be far less secure than most folks realize.

An estimated $1.36 billion worth of crypto tokens, including at least 46,000 Bitcoins, were stolen in the first five months of 2020, according to CipherTrace. You'll get absolutely no protection from the Federal Deposit Insurance Corporation, either.

8. The tax situation can be burdensome

If you think you hate doing your taxes now, try getting involved with Bitcoin. Since the Internal Revenue Service views cryptocurrency as property, all dispositions must be accounted for via capital gains and losses. You'll have to report more than just buying and selling Bitcoin.

If you purchase Bitcoin and sell it to buy another cryptocurrency or a good/service, you'll have to report your cost basis and disposition price. It sounds burdensome, especially if you're using Bitcoin to buy goods and services.

IMAGE SOURCE: GETTY IMAGES.

9. It's driven purely by emotions and technical analysis

There are only two true drivers to Bitcoin's value: investor emotions and technical analysis (i.e., pretty charts). Neither of these is a particularly intriguing reason to buy in, especially since neither will help over the long run.Fear of missing out (FOMO) and cheerleading from the likes of Tesla CEO Elon Musk have fueled this record run higher in Bitcoin.

As noted earlier, utility remains poor, scarcity is a myth, and the barrier to entry is virtually nonexistent. What we're seeing is day traders having a field day, and that's not something I want my money in.

10. History is undefeated

Finally, history is undefeated when it comes to next-big-thing investment bubbles bursting. You can look back more than a quarter of a century to the birth of the internet, business-to-business commerce, genomics, 3-D printing, marijuana, and even blockchain.

No matter what the next great advancement was, the bubble eventually burst. These trends did eventually produce winners, but history suggests that parabolic moves in assets tied to next-big-thing trends aren't sustainable.For these 10 reasons, I don't plan to invest in Bitcoin.

Newly released! 10 stocks we think you should buy right now

Investing geniuses David and Tom Gardner revealed what they believe are the ten best stocks for investors to buy right now…And when the Gardner brothers have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

With a charity and some slapdash art theory as a cover, a copycat makes off with 512 ETH in NFT sales.

As the Crypto Twitter community debates the fair value of Cryptopunks and other NFTs rising to sky-high valuations, there’s at least one clear sign of the digital collectibles market growing irrational:

An individual posing as Banksy, perhaps the most famous living artist, has netted over $1 million in Ether (ETH) in NFT sales. Starting on Sunday, Feb. 14, frequent browsers of the NFT marketplaces Opensea and Rarible noticed an account named “Pest Supply” with branding and nonfungible tokens made in Banksy’s signature graffiti-stencil style.

Many were quick to jump in, given the “real” Banksy’s habit for pop-up installations:

Wallet profiler Nansen shows that the individual’s listed address first became active on Feb. 13 and was most active yesterday, Feb. 19.

Before Opensea wiped much of the account history and disabled further sales, the account’s records showed hundreds of sales to buyers ranging from 0.116 ETH to over 60 ETH for a piece titled “NFT morons.” Noted whale wallet 0xb1 also made a few purchases, including one transaction worth 34 ETH, or $68,000.

In an email obtained by Cointelegraph, Banksy’s “legal guardian,” Pest Control, has denied any association with the NFTs.

Likewise, the individual has indicated that they are selling knock-offs, comparing themselves to artist Elaine Sturtevant, who was known for inexact replicas of more popular artists’ work, on their Rarible bio.

The account has taken in 512 ETH total, per Nansen, with nearly 430 ETH sent to a secondary address. The individual’s Rarible page includes a set of screenshots and Etherscan transactions ostensibly proving 23.5 ETH in donations to Save The Children, a humanitarian organization — less than 5% of the individual’s total haul.

Duped collectors are now left wondering, however: Were we tricked?

Could it be a double-bluff and a genuine Banksy installation? Do the NFTs have value either way?Real or fake? Who cares?

Max Osiris, a prominent crypto artist, tipped off the community that Banksy’s “legal guardian,” Pest Control, had denied any association with the NFTs in an email:

The email exchange, which Osiris forwarded to Cointelegraph, shows Osiris asking if the NFTs are Banksy works listed “legit undercover,” and Pest Control responding by saying “there isn’t an affiliation in any way, shape or form.” Cointelegraph has reached out to Pest Control and received no response.

This alone doesn’t prove that the NFTs are faked Banksy work, however, as Pest Control is known for denying association with ongoing installations. Instead, the individual’s Rarible page is now the clearest indication that they are not associated with Banksy.“Locked by decentralized OpenSea as they have no idea who Elaine Sturtevant is and know nothing about art history. This is art history in making,” reads the individual’s bio.

Sturtevant is known for recreating the works of more famous artists from memory, a method that some believe raises philosophical questions regarding the nature of authenticity and originality.

The art blog NFT Art Review supports the view that the fake Banksy is working in this mode, writing that the individual performed “phenomenal appropriation art that dissects the perception from the collecting circle and how value can be created from satire.

” The individual may have updated their Rarible bio on Friday night in direct response to the the blog, which was published on Friday morning. Osiris believes it’s ultimately up to the collector to make these value judgements, and it’s also up to them to protect themselves from fakes — whatever that means.

“Yes, I think art has value even if it’s a fake because it’s up to the collector to figure out what they’re getting. In a sense this is a pretty successful art project, especially if the money goes to where they claim it will go,” he said, referencing the individual’s charity efforts.

Two of the currently listed works done in Banksy’s style are priced at over 100 ETH, or $200,000 each. The individual claims to have donated roughly $47,000 to charity.Signs of froth

Noted NFT collector-whale Pranksy marked perhaps the clearest sign of an overheated market with his own NFT run, a true hat-on-a-hat named “Pest Demand.

”While he says he made the run in an effort to “mock” the fake Banksy, he instead made 12 ETH, or $24,000, in sales.

“People bought it because they are all euphoric,” Pranksy said.Artist “Twerky Pepe” highlighted the absurdity of the situation with a tweet, in which they promoted their Pranksy purchase as either a good investment or a fun, ironic buy (the Cointelegraph weekend editorial team was unable to divine which):

Osiris agrees that the collectors and speculators are overeager at this stage in the market and says that the artist, in fact, exploited those very sentiments.

“It’s a clever slight-of-hand move by someone who timed the excitement of ‘celebrities’ coming into the space, the mystery of Banksy’s modus operandi, and Rarible’s verification system,” he said.

The individual was able to gain a Rarible “yellow checkmark” because they were not, in technicality, posing as Banksy, just using Banksy’s style and legal likeness.It’s mania that may only get worse, he said.“The frenzy around NFT’s has created a sort of monster where people are trying to rush in and be the first to get something that becomes valuable and fail to look deeper or do more research.”

Sales for the individual’s fake Banksies continue apace, with at least a dozen NFTs purchased in the last twelve hours.-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

With much of the world focused on bitcoin and ether as prices breach new all-time high after all-time high, the “Money Reimagined” crew embarks on a more nuanced journey, one that eschews world-changing networks for an art-changing renaissance that’s been long in the making.

We’re talking, of course, about the nonfungible token (NFT) movement that has engulfed the world of crypto collectibles. With big brands like Christie’s auction house and the National Basketball Association getting involved and some tokens already selling for six-figure sums, the question isn’t if NFTs will force a very old industry to adopt some very new practices, it’s when.

On today’s episode of CoinDesk’s “Money Reimagined,” Michael Casey and Sheila Warren are joined by Nanne Dekking, CEO of Artory and formerly the top salesman at Sotheby’s.

Founded in 2016, Artory is creating the first standardized data collection solution by the art world, for the art world. In his former position at Sotheby’s New York, Dekking was vice chairman and the worldwide head of Private Sales. His close relationships with collectors and museums were integral to the continued growth of private sales at Sotheby’s.

Prior to joining Sotheby’s, Nanne was vice president of Wildenstein & Co. He advised individuals, museums and foundations on the formation and development of their collections. From 1996-2001 Nanne was the founder and principal of Nanne Dekking Fine Arts, an art consultancy firm and gallery in New York.

“Which scholar do I trust? Who in the art market do I trust?” Dekking said. “They don’t want to trust anyone.”

In this wide-ranging introduction to NFTs, collectibles and the traditional art market, the discussion ranges from Sheila Warren’s Cryptokitty genealogy to the challenges of selling paintings by the old masters in litigious modern markets, plus a whole lot more.

See also: Government Reimagined, With Jeff Saviano and Glen Weyl